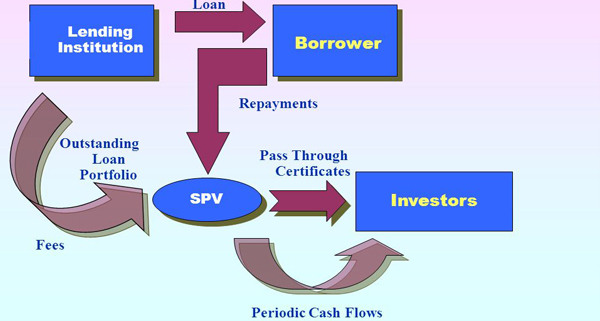

Securitisation of Receivables

Companies of all sizes and credit profiles use securitization to achieve significant cost savings in comparison to other forms of debt. Due to the highly structured nature that is characteristic of these transactions, securitization lenders can provide capital at a relatively low price. Below are a number of factors to consider related to securitization.

Securitization allows your company to receive cash due from its trade receivables immediately, despite the fact that the payment terms may be 30 days or more. The interest cost is relatively low because the receivables’ cash flows are legally segregated and protected from other creditors in the event of a bankruptcy. This legal separation of the receivables has no impact on the company’s operations; the business continues to manage its accounts receivable (and customers) in the same manner as it did before the securitization. Securitization does not require changes to your credit and collection policies or procedures, and the process is completely transparent to your customers. Customers continue to make payments into the same company accounts used prior to establishing a securitization, and customers are not notified or aware that the receivables have been securitized. Unlike a factoring program, receivables are pledged, rather than sold, to securitization lenders, and lenders do not take any equity, or upside, in the receivables. The proceeds from the securitization can be used to originate more assets, to reduce outstanding debt with higher interest costs or to provide for other capital needs.

Key Benefits Of Securitizing Receivables

- Securitized debt has a lower interest

- Banks are generally willing to commit much larger amounts

- Securitization preserves capacity in the bank market.

- Securitization can increase your company’s total liquidity

- Securitization is non-recourse financing

- Securitization can enhance the enterprise value.