Deals Executed

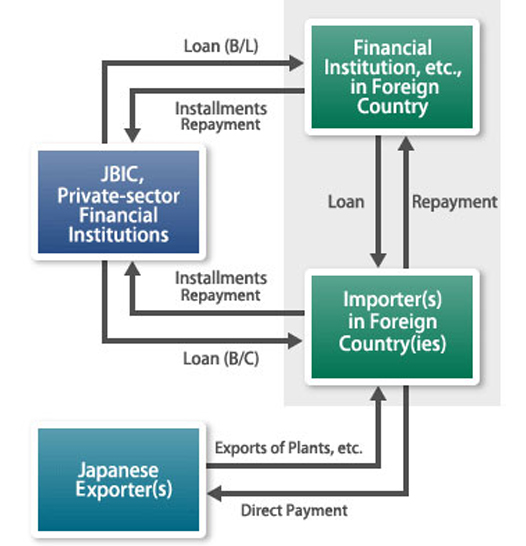

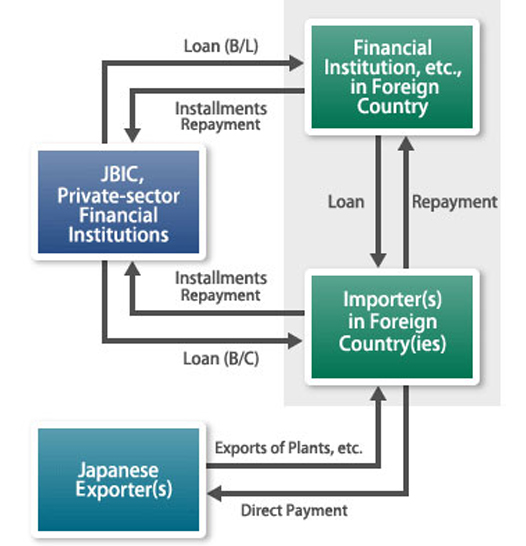

External Commercial Borrowing

External Commercial Borrowing+

External Commercial Borrowing

A Mumbai based corporate group with a turnover of 400 Crs operating in the Tier II Manufacturing segment of Automobile Industry. This Company was looking to expand their operations by way of introduction of certain new product lines which got approved with auto companies like VolsWagon, Dalmier Chrysler etc. The Group wanted to fund the entire transaction by way of an ECB, as the company was slated to get export orders of such new components from the clients mentioned above.

We arranged the ECB from a Multinational Bank to enable this transaction. Since there was very high variability in USD the company chose to borrow in Euro (lesser volatile) and the production line was to be imported from German Vendor who had agreed to accept Euro Payments

The funding was done for a tenor of 7 years with 1 year Moratorium with Monthly Repayments.

External Commercial Borrowing

External Commercial Borrowing+

External Commercial Borrowing

An unrated company in the business of chemicals trading with a turnover of about Rs 85 cr involved primarily in the business of importing chemicals – Specialty Chemicals & APIs – and distributing them in India wanted to set- up a manufacturing facility in India. They identified a chemical that was not manufactured in India and had huge applications. The current requirement of the industry was being serviced by imports, primarily from Japan & South East Asia. The company tied up with a Japanese manufacturer to get the technical know-how and wanted to implement the project.

We convinced one of the banks, we deal with often, to look at the merit of the project and the inherent strength and integrity of the promoters. Post the relevant due diligence, when they were convinced of our views, they went ahead and sanctioned the required amount in ECB at Libor- linked rates., resulting in significant cost savings for the company and the project is being set-up at internationally competitive costs.

Overseas Acquisition Funding

Overseas Acquisition Funding+

Overseas Acquisition Funding

A listed Company (Rated A+), based in Hyderabad, in the business of Digital Marketing Solutions has achieved the status of leadership in the industry by becoming a 1250 Crs company in a span of 12 years. This company sensed that it was time they made a related diversification by forward integration. In line with this aim, the company wanted to target and acquire Health Care IT companies abroad.

We joined hands with the company with the following objectives: The company, being conservative, wanted to arrange funds first and then look for targets. Since all the assets owned by the company were already pledged to their consortium banks, they wanted to structure the limits in a manner that it does not require any additional security Since they were already supplying to more than 10 countries worldwide, they wanted to have a sanction with the freedom of acquiring a company anywhere in the world. We worked closely with a bank and the company to structure limits for acquisition and finally got an approval with the following terms: The company can acquire the company anywhere in the world The limits to have second charge on all the assets of the company – first charge with the consortium An FD of 15% of the limits to be given – in line with the collateral security given to the consortium The banks to be inducted into the consortium with small limits The due-diligence report and the financials of the target company to be shared with the company before the final acquisition

With this approval in hand, the company is negotiating few companies in USA & UK for possible acquisition.

Foreign Currency Term Loan

Foreign Currency Term Loan+

Foreign Currency Term Loan

A 32 year old 330 cr Garment Manufacturing Company, based in Mumbai, was setting up a brown field project with an overall outlay of 100 Crs. The new manufacturing facility, being set up in SEZ, was dedicated to exports. The company had identified state-of-the-art machines from Germany & France Adding upto 46 Crs, out of the total Debt requirement of 70 Crs.

We arranged the Term Loan of 40 Crs in Foreign Currency (Libor-Linked Rates) from an Indian Special Purpose Bank to enable this import of Capital Goods. The remaining 30 Crs was done as rupee funding for construction of Building & purchase of indigenous machines. The entire funding had a tenor of 7.5 years with 1.5 year Moratorium with Quarterly Repayments. We took Three Month to execute this transaction entirely.

Term Loan for Import of Capital Goods

+

Term Loan for Import of Capital Goods

+

Term Loan for Import of Capital Goods

A Mumbai based company with a turnover of 45 Cr engaged in the business trading of Industrial Safety Products, had planned to put up a new manufacturing facility to manufacture Seamless Industrial Safety Hand Gloves. This new project will actually reduce the client's overall dependence on imports. The promoters had imported these machines on credit & were looking to fund this project from their existing banker. Since there were accumulated losses on the client Balance Sheet, the existing banker was reluctant to enhance their exposure.We arranged the Term Loan from a Nationalised Bank to reimburse the imports at current exchange rates. The nationalised bank also took over the entire WC limits of the existing banker along with an enhancement. The funding was done for a tenor of 5 years with Quarterly Repayments.

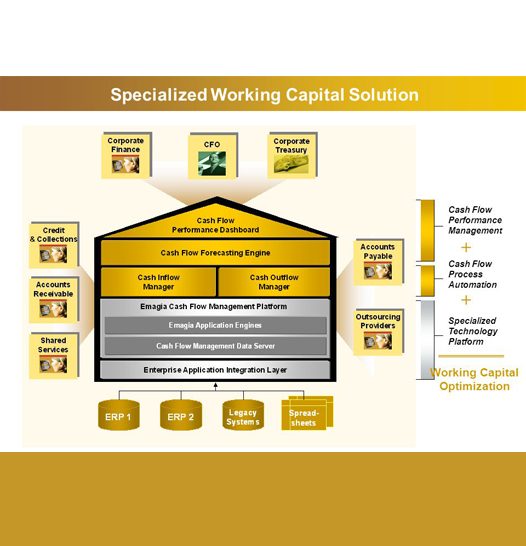

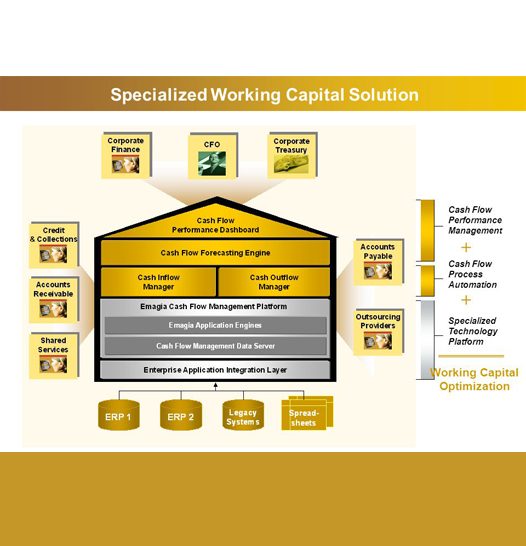

Specialised Working Capital Finance

+

Specialised Working Capital Finance

+

Specialised Working Capital Finance

A Rs 1000 cr Company (Rated A-), based in Mumbai, in the Jewellery Industry, had a Working Capital Limit of Rs 425 cr from a consortium of 12 banks – 6 Nationalised, 4 Private & 2 Foreign Bank. The Working Capital Limits were in the form of Fund-based Export Finance & Non-Fund-based SBLC/ BG for purchase of Gold. The company directly imports Gold as it is an Agency Nominated by RBI. For this purpose, they open SBLCs in favour of banks like Bank of Nova Scotia, Standard Bank etc. Since the banks who supplied Gold to the Company had a Bank-wise Cap on all the banks operating from India and because this cap was a consolidated cap in terms of exposure to these banks for all transactions, often there were no limits available to do the Gold transaction even though the Gold-Supplying Bank had free limits on the Company and the Company had free Working Capital Limits.

In order to achieve the objective, we talked to the Gold Supplying Banks. We found that there are a few banks where these Gold Supplying Banks have huge limits and that these limits are normally not utilised because these banks are averse to entering into working capital relationships with their clients. They preferred to operate on Term Loans only. We convinced one of these banks to look at working capital limits for this company and arranged SBLC limits from them. After this, the company has never been bothered to look for Banks that have free limits with the Gold Supplying Institutions.

Working Capital Term Loan

Working Capital Term Loan+

Working Capital Term Loan

A 50 year old Rs 115 cr business group, based in Mumbai, operating in the OEM segment (Electrical Assembly & switches) of Automobile Industry. The company had been facing rough weather due to delayed payments & a general slowdown in the Automotive Sector. The company had reached a stage where the total creditors were approx 20% of their entire sales. At the same time , the creditors had stopped extending further credit to the company for purchase of Raw Materials. The existing Bankers had stopped supporting the company due to delayed payments & exhaustion of their existing Limits.

The requirement of company was very specific & time bound. We arranged a WCDL of 19 Crs to pay off creditors, with a first pari passu charge on the entire assets of the company. The tenor of this loan was 7 years with 6 months Moratorium. We delivered this sanction within 15 working days.

Enhancement Of EPC/ FUBD Loan

Enhancement Of EPC/ FUBD Loan+

Enhancement Of EPC/ FUBD

A 27 year old Diamond Processing & Trading company (DTC Sightholder), based in Mumbai, having a turnover of over Rs. 100 crs. The company had been enjoying Rs. 25 Crs EPC/FUBD. The existing bankers had not enhanced the limits ever since they funded the company in 2011. The company had exports to the tune of 85% of their turnover. Due to lack of enhanced facilities the company was not able to invest more in purchase of raw materials & inventory, which led to loss of export business to competition.

The company required Rs. 40 crs EPC/FUBD facility to ramp up the exports immediately. We arranged a EPC/ FUBD of Around 40 Crs. We delivered this sanction within 60 working days.

Commercial Vehicle Term Loan

Commercial Vehicle Term Loan+

Commercial Vehicle Term Loan

A 23 year old Rs 280 cr Logistics company, based in Mumbai, having a focussed approach of providing logistics solutions to Metal & Mining Industry. The company had been going thru facing rough weather due to delayed payments & a general slowdown in the Mining Industry. The company had contractual contracts with Metal manufacturing giants like TATA Steel, JSW Ispat, SAIL & other similar names in the heavy engineering goods business viz. BHEL, Crompton Greaves etc. The company had received extended contracts from TATA Steel & Hindustan Zinc Ltd. for carriage of their output to Western & Southern India. In order to execute these contracts the company had to enhance vehicle fleet by 50 Trailers. Given the current market conditions & ĐoŵpaŶLJ͛s explicit condition of raising cheap funds thru Banks/NBFC͛s without any personal / corporate guarantees offered to the lender. Their existing Banker had stopped supporting the company due to delayed payments & exhaustion of their existing limits.

The company required truck trailers immediately, as TATA Steel͛s contract required the company to start deploying trucks trailers by 30th Sep. We arranged a Commercial Vehicle Funding of Around 12 Crs without any Collateral OR Corporate/Personal Guarantee from the promoter group. The tenor of this loan was 3 years without Moratorium. We delivered this sanction within 30 working days.

Interest Cost Reduction Mandate

Interest Cost Reduction Mandate+

Interest Cost Reduction Mandate

A 21 year old Rs 40 cr turnover hospitality company, based in Mumbai suburbs, having a focussed approach of providing hospitality solutions mainly to Pharma Sector, apart form owing a CLUB. The company had been going great guns & had an overall 85% Occupancy Levels, which was unparalleled in the hospitality sector. The existing bankers had funded around 16 crs over these years @ 13.50%. In order to tap the existing clients in pharma sector, the company needed to increase their capacity by about 70 additional rooms, in the same premises as there was FSI available within the permissible limits. Given the current market conditions & ĐoŵpaŶLJ͛s explicit condition of raising cheap funds thru Indian Banks only.

We arranged the takeover of existing 15.43 Crs of Term Loans & 3 Crs of OD/CC facility @ 11.50%. We also got additional 30 Crs funded at 11.50%, with a 10 yr door to door tenor & a moratorium of 18 months. The company was extended a ballooning repayment structure to ensure the low risk of reduced profitability.

Working Capital for Subsidiaries Abroad

+

Working Capital for Subsidiaries Abroad

+

Working Capital for Subsidiaries Abroad

A Hong Kong-based subsidiary company of a large corporation in India, having operations in Singapore & Philippines, needed USD 10 million financing from the local financial institutions as working capital for daily operations, but due to limited strength of the subsidiary, was unable to procure credit line from the local banks. So the company, approached us with the issue to get the financing done in Local Country. The Indian parent company had banking relations with nationalized banks in India, which had week presence in Philippines. Moreover the correspondent banks in Philippines had very small credit lines for India as a country.

We had approached EXIM bank to issue a SBLC for the subsidiary in Hong Kong in favor of Bank of China (Hong Kong), guaranteeing the subsidiary company will repay the principal and interest of loan on time. With the guarantee of EXIM Bank, Bank of China (Hong Kong) granted the subsidiary company a loan of USD 10 million to solve its financing difficulty.