The fastest way to grow your business by adapting optimum capital mix. Learn more

Domestic Acquisition Finance

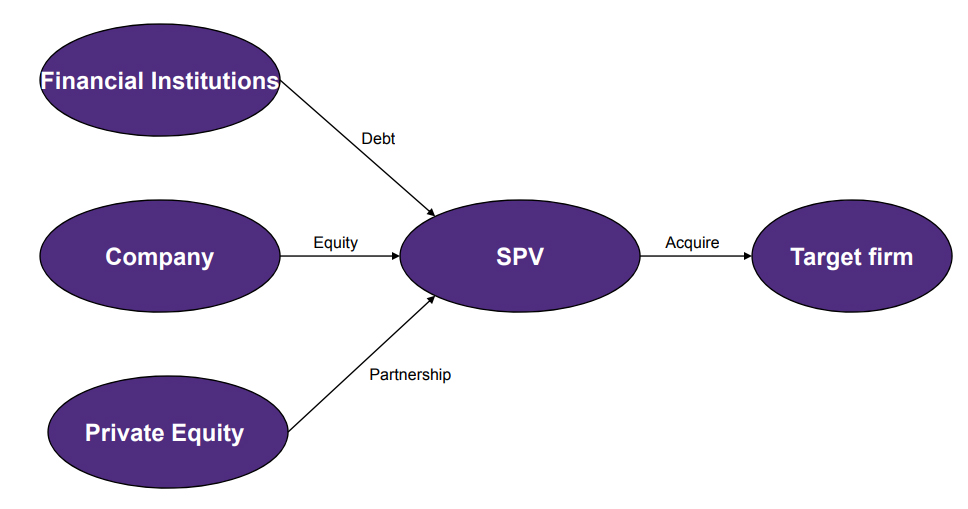

While Indian Corporates are aggressively expanding their horizons their counterparts offshore are acquiring in India. While availability of funds is a favorable driver for investments, it has been the structuring options devised for Indian acquirers which have enabled them to make acquisitions offshore. Nevertheless, such hurdles should not be seen as a deterrent. It then looks into domestic sources of .finance, statutory restrictions on loans from Indian banks, limits on capital market exposure, structured instruments etc. we help Indian as well as Overseas companies to do acquisition in India of existing businesses/companies OR Green Field businesses.

Overseas Acquisition Finance

Although the Indian deals market has been abuzz with large acquisitions, both national and cross-border, what is notable is the growing trend among Indian corporates of acquiring companies far larger than themselves in offshore jurisdictions.

Indian Companies investing abroad for, setting up manufacturing units and for acquiring overseas companies to get access to foreign markets, technology, raw material, brand, IPR etc. For financing such overseas investment by Indian companies we facilitate

- Term Loans to Indian Companies to fund the acquisition or JV participation, basis their strength in Indian business & Collateral in India

- Term Loans to Overseas JV towards part financing of

- Capex towards acquisition of Asset

- Working Capital

- Equity Investment in another company

- Acquisition of brands/ patents/ rights & other IPR’s

- Acquisition of another company

- Guarantee Facility to the overseas JV for raising Term loans / Working Capital in their local country

External Commercial Borrowings

ECB is basically a loan availed by an Indian entity from a nonresident lender. Most of these loans are provided by foreign commercial banks and other institutions. It is a loan availed of from non-resident lenders with a minimum average maturity of 3 years.

External Commercial Borrowings (ECBs) includes commercial bank loans, buyers' credit, suppliers' credit, securitized instruments such as Floating Rate Notes and Fixed Rate Bonds etc., credit from official export credit agencies and commercial borrowings from Multilateral Financial Institutions. ECBs are being permitted by the Government as a source of finance for Indian Corporate for expansion of existing capacity as well as for fresh investment. Following are the advantages of ECBs.

Advantages of ECBs :

- ECBs provide opportunity to borrow large volume of funds

- The funds are available for relatively long term

- Interest rate are also lower compared to domestic funds

- ECBs are in the form of foreign currencies. Hence, they enable the corporate to have foreign currency to meet the import of machineries etc.

- Corporate can raise ECBs from internationally recognised sources such as banks, export credit agencies, international capital markets etc.

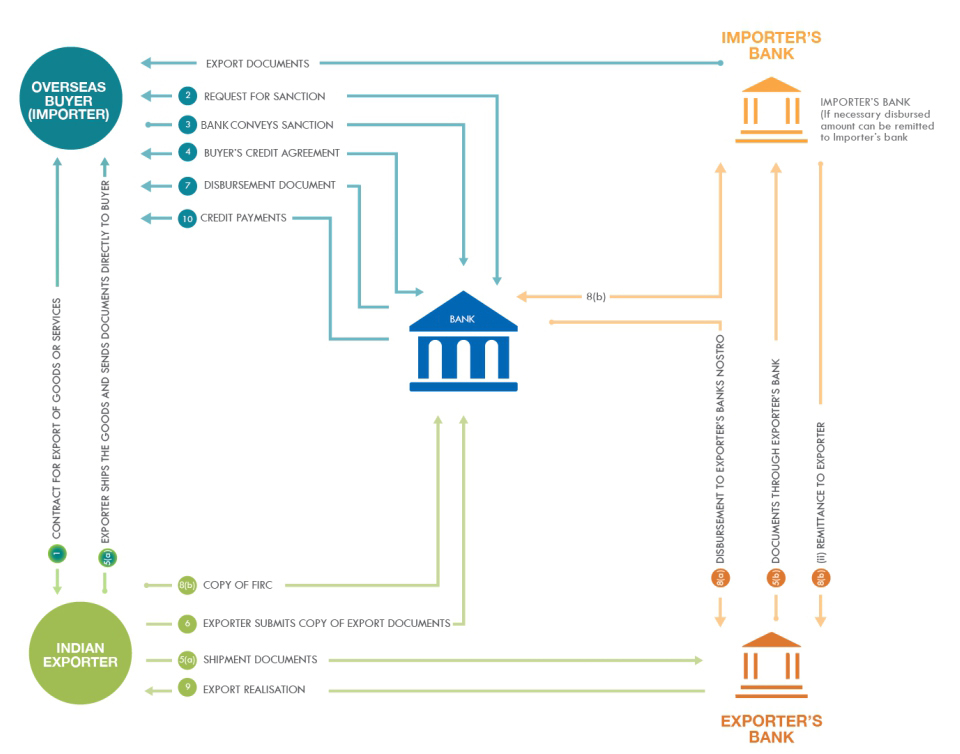

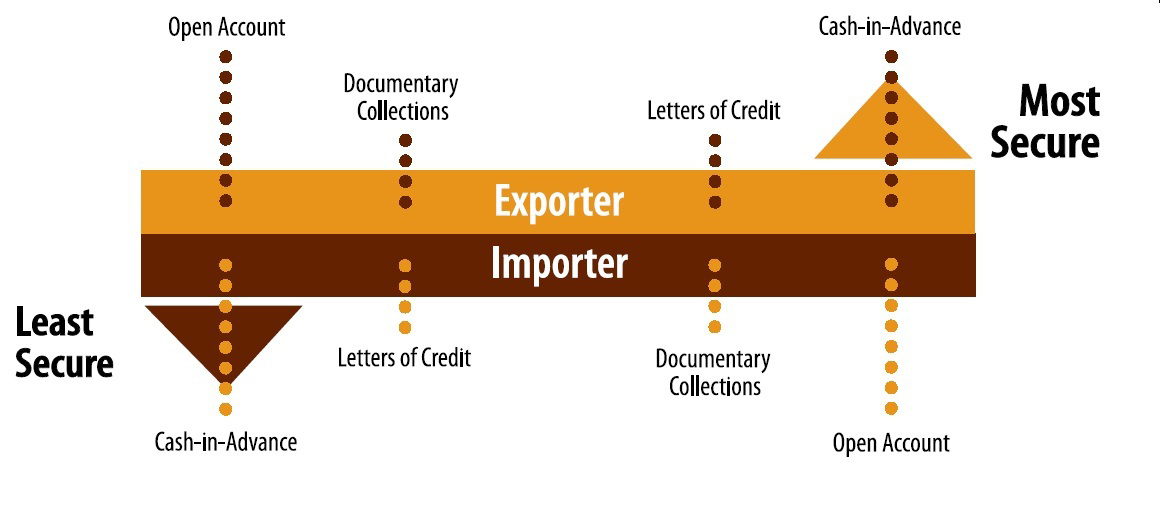

Buyers Credit & Export Finance

A buyer's credit is a loan facility extended to an importer by a bank or financial institution to finance the purchase of capital goods or services and other big-ticket items. Buyer’s credit is a very useful mode of financing in international trade, since foreign buyers seldom pay cash for large purchases, while few exporters have the capacity to extend substantial amounts of long-term credit to their buyers. A buyer’s credit facility involves a bank that can extend credit to the importer, as well as an export finance agency based in the exporter's country that guarantees the loan. Since buyer’s credit involves multiple parties and cross-border legalities, it is generally only available for large export orders, with a minimum threshold of a few million dollars.

Unsecured Loans

An unsecured business loan requires no collateral. This means you do not need to pledge any asset, tangible or otherwise, to get such as loan. When it comes to an unsecured business loan, we know that there is a risk of default, and therefore, we have no legal right to seize your assets if you can’t repay the loan. However, while you don’t need to put up collateral against an unsecured business loan, we would still require your business to have strong annual revenue, several years of operating history, and excellent credit history to qualify.

Advantages for SMEs:

Whether you are expanding into a new vertical or growing your existing business, you can avail of a small business loan for finance. In today’s fluxing economic climate, nearly any enterprise can see immediate growth as long as they use the business loan wisely.

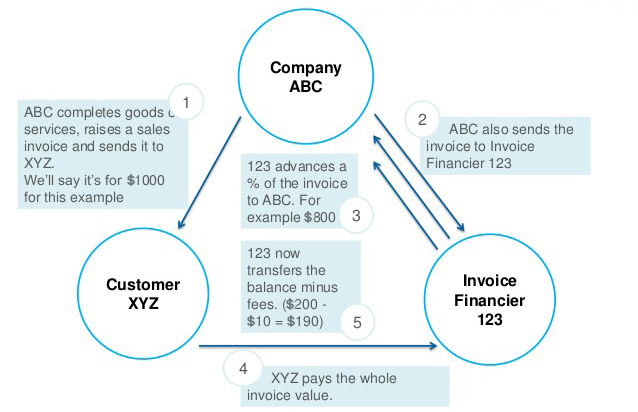

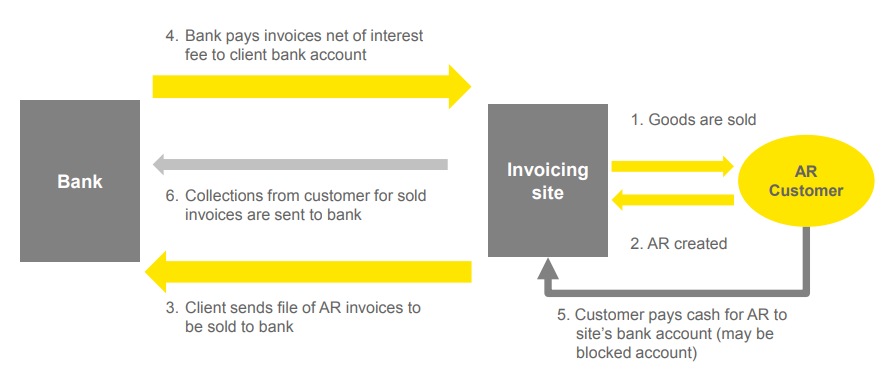

Invoice Finance & Purchase Bill Discounting

Fund Based assistance offers both Purchase and Sale Bill Discounting and also Invoice Discounting for OEM /vendors to large Corporates.

Under this type of lending, Bank takes the bill drawn by borrower on his (borrower's) customer and pay him immediately deducting some amount as discount/commission. The Bank then presents the Bill to the borrower's customer on the due date of the Bill and collects the total amount. If the bill is delayed, the borrower or his customer pays the Bank a pre-determined interest depending upon the terms of transaction.

Bills are classified into four categories as LCBD (Bill Discounting backed with LC), CBD (Clean Bill Discounting), DBD (Drawee Bill Discounting) and IBD (Invoice Bills Discounting).

Bill Finance constitutes a vital part of the working capital finance and is a major Trade Finance activity.

Bill Discounting Features :

- Bullet Bank offers discounting of bills up to original tenor of upto 180 days.

- Bullet Bill discounting facility offered as Sale Bill Discounting or Drawee Bill Discounting

- Bullet Bills under LCs issued by domestic banks/branches (LCBD) under simplified procedure

Invoice Discounting Features :

- Bullet Especially useful for OEM / vendors to large corporate

- Bullet No bill of exchange / No acceptance

- Bullet As an overdraft facility or bill discounting facility

- Bullet FIFO method for interest calculation

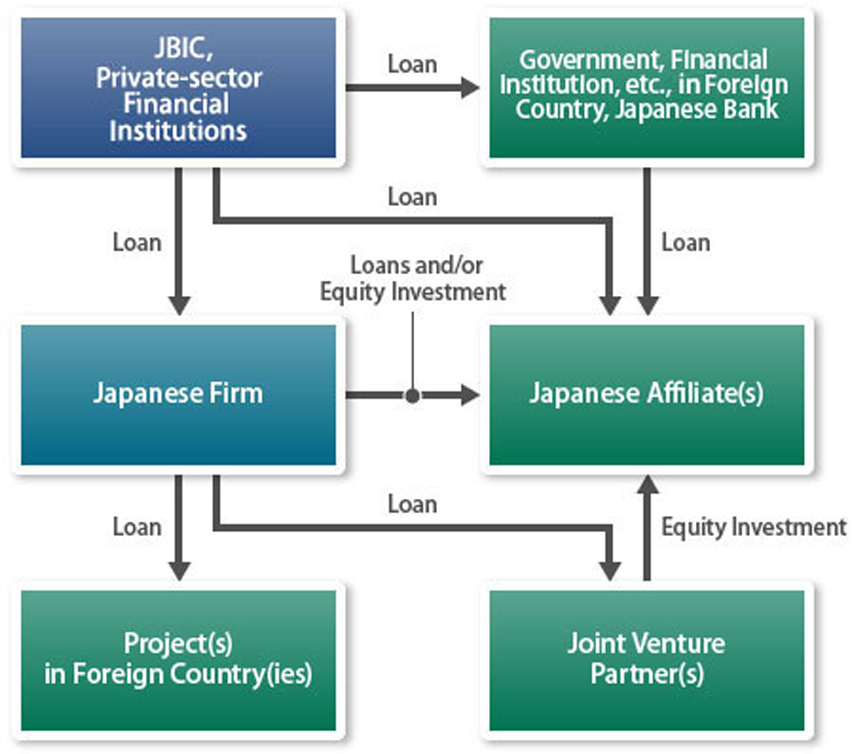

Finance For Overseas Project Execution

We are active in arranging finance for Project export activities. Project export contracts are generally of high value and exporters undertaking them are required to offer competitive terms to be able to secure orders from foreign buyers in the face of stiff international competition.

- Export of engineering goods on deferred payment terms

- Execution of turnkey projects abroad

- Execution of overseas civil construction contracts abroad

- Exports of services are the contracts for export of consultancy, technical and other services.

Various types of credit facilities, both non fund and fund based, that the project exporters may need at the time of bidding and/ or for execution of the project are arranged by us.

The Policy gives greater priority for projects in Infrastructure, Power, Oil Exploration, Telecom, Railways, Roads & Bridges, Ports, Industrial Parks and Urban Infrastructure and Export Sectors.

Banks makes or guaranties a loan to a project company, and in underwriting this type of transaction, Banks are relying mainly on the overseas project for repayment of the loan. Banks carefully analyzes the economic, technical, marketing, and financial soundness of the project to determine its creditworthiness.

There must be adequate cash flow to pay all operational costs and to service all debt. It is expected that collateral, in the host country, will be provided to secure the loan. The project sponsors are expected to support the overseas operation until certain specific tests for physical completion, operational implementation, and financial soundness are met. To the extent that project financing is appropriate, sponsors may not need to pledge their own general credit beyond required completion undertakings.

Working Capital for Subsidiaries Abroad

At the request of parent companies in India, Banks issue guarantee’s in favor of the overseas financial institutions providing financing or credit lines to the local enterprises wholly or partly owned by the parent companies, to guarantee these overseas enterprises fulfill their obligations to repay the principal and interest of loans or the fund according to the credit line agreement.At the request of parent companies in India, Banks issue guarantee’s in favor of the overseas financial institutions providing financing or credit lines to the local enterprises wholly or partly owned by the parent companies, to guarantee these overseas enterprises fulfill their obligations to repay the principal and interest of loans or the fund according to the credit line agreement.

Functions

Address the difficulties faced by the Indian-invested enterprises abroad on fund shortage and credit line, and provide financing services for overseas development of the "Going out" enterprises.

Features

Indian invested enterprises abroad can procure credit support from local financial institutions through bank guarantee obtained based on the strength of the parent companies at home.

Application Qualifications

- The applicant shall have the qualification to engage in underlying transactions;

- The applicant shall maintain good credit standing without any bad record;

- The applicant shall have sufficient credit line or be able to pay sufficient margin necessary for issuing the letter of guarantee;

- The applicant shall possess real relationship of transactions that meets Banks requirements on business compliance;

- The applicant shall provide complete and valid business information.

Finance for Land Purchase

If you’re looking for a loan to purchase land, a Home Loan will not cover all the aspects of buying an empty plot. What you need is a loan designed specifically for buying land. This facility is not available for Buying Land for Industrial / Commercial or Construction projects.

Land Purchase Loan should be your loan of choice in situations when :-

- You’re purchasing a plot through direct allotment

- You’re buying a resale plot

A loan for land purchase allows you to fund your plot purchase quickly and with utmost ease. If you are in need of more funds once you start construction, opt for Top-Up Loan which is available to all existing customers who do a Home Loan Balance Transfer.

Loan Against Gold

Loan against gold this product is designed to provide liquidity against gold and gold ornaments without having to sell them. This product is ideal to meet agriculture and allied agriculture requirements like cultivation, dairy, poultry, fishery, etc. gold coin and gold ornaments lying idle can be put to productive use by availing Loan against Gold and Gold Ornamen

- Hassle-free quick processing of loans.

- Simplified paperwork.

- Easy payment options.

- Attractive interest rate

-Loans1.jpg)

FCNR (B) Loans

FCNR(B) stands for Foreign Currency Non-Resident (Bank). FCNR(B) loans are thus loans raised by Indian corporates in foreign currency as per the guidelines issued by Reserve Bank of India. FCNR loans are sometimes preferred by Indian businesses as it entails lower interest cost and the borrower does not have to go to international market for raising funds at competitive rates.

FCNR Loan Eligibility

FCNR loans are usually only provided to well established corporates operating as a private limited company or limited company in India with a very good track record of repayment. FCNR loan can be availed for a wide variety of purposes ranging from working capital requirement to purchase of capital equipment. However, most banks require a minimum loan requirement of USD100,000 for processing FCNR loan application by any bank.

FCNR Loan Advantages

- FCNR loans have very low interest rates when compared to loan designated in Indian rupees. FCNR loans have interest rates of 6 Month LIBOR + 1% – 4%, based on the borrower risk profile.

- FCNR loan can be easily obtained through banks in India.

- Can be used to hedge currency exposure risk.

FCNR Loan Disadvantages

- Small businesses would not be eligible.

- FCNR loan must be hedged for currency fluctuation.

- Exposes the business to currency and international market risks.

FCNR Loan Usage

FCNR loan can be used for a wide variety of purposes as mentioned below:

- Working Capital - FCNR loan can be extended for working capital purposes in Indian rupees or foreign currency. Exporters can avail foreign currency loan for working capital purposes as pre-shipment credit or post shipment credit in foreign currency. While using FCNR loan for working capital purposes, it is recommended that the business have a natural hedge or cover itself from exchange risk.

- Importing of Raw material - FCNR loan can be used by importers while importing raw material instead of rupee based loans. Availing foreign currency loan for raw material and exporting goods would ensure the business has a natural hedge, as foreign currency loans can also be repaid in foreign currency. A part of working capital limit can be earmarked as foreign currency loan in the overall sanctioned working capital facility.

- Importing Capital Good - Those importing machinery or equipment from abroad can avail FCNR loan for a period not exceeding 3 years including moratorium period. Importing capital good backed by Letter of Credit denominated in foreign currency or with FCNR loan will ensure that the business enjoys very low interest rate on the capital equipment imported for a period of upto 3 years. Normally, the import of capital goods should be arranged on 180 days usance basis.

- Repayment of Rupee Term Loan - FCNR loan can be used to repay rupee term loan provided the duration of the foreign currency loan does not exceed the portion of the existing rupee loan which has not yet expired or 3 years whichever is less. Replacing rupee term loan with FCNR loan that is hedged can reduce interest cost.

- Repayment of ECB’s - External commercial borrowing (ECB) in the form of foreign commercial bank loans, buyers credit, suppliers credit, corporate bonds, etc., can be repaid with FCNR loan after obtaining permission from the Government of India / RBI as per the applicable guidelines.

Foreign Currency Term Loan for Import of Capital Goods

Foreign Currency Term Loans (FCTL) can be disbursed in four currencies viz. US$, Sterling, Euro and Japanese Yen with a maturity period of 6 months to 7 years. It can be repaid by bullet payment or in stipulated instalments or by conversion of rupee term loans, as per the terms of the original sanction.

Different corporates borrow funds for different purposes such as:

- For working capital requirements in Indian Rupees

- For the pre-shipment advances/ post shipment advances to the exporters

- Import of raw materials

- Import of capital goods

- Purchase of indigenous machinery

- Repayment of the existing Rupee Term Loan

- Repayment of existing ECB's

Following is the eligibility criteria to be able to get the FCTL facility:

- Exporters for working capital needs

- Importers for meeting import obligations or capital goods

- Existing borrowers for foreclosure of the medium-term FC Loans

- Loan to JV/WOS entities of Indian companies

- High value corporate clients with a good track record, to meet working capital requirements in substitution of WCDL

- Borrowers requiring conversion of rupee term/cash credit

Lease Rental Discounting

Owning a commercial or residential property in India comes with its share of advantages – the principal one among them being that the property owner is able to lease out the premises to earn rental income. Apart from monetising the property, the rent receivables also yield an additional benefit to the owner: he can raise a term loan against the rent for personal or business intents. This loan is known as Lease Rental Discounting (LRD) and is approved against the discounted rentals of the property and its current market value.

Features of Lease Rental Discounting

- Collateral: Residential and commercial property under lease

- Property credentials: Clear title, no existing borrowings on the property, lease agreement should be over 6 months old at the time of application

- Tenure: Up to 12 years

- Maximum loan amount: Rs 150 crore (not more than 80 % of the property value)

- Benefits: Attractive interest rates, loan transfer from other institutions along with top up facility, faster processing

Securitisation of Receivables

Companies of all sizes and credit profiles use securitization to achieve significant cost savings in comparison to other forms of debt. Due to the highly structured nature that is characteristic of these transactions, securitization lenders can provide capital at a relatively low price. Below are a number of factors to consider related to securitization.

Securitization allows your company to receive cash due from its trade receivables immediately, despite the fact that the payment terms may be 30 days or more. The interest cost is relatively low because the receivables’ cash flows are legally segregated and protected from other creditors in the event of a bankruptcy. This legal separation of the receivables has no impact on the company’s operations; the business continues to manage its accounts receivable (and customers) in the same manner as it did before the securitization. Securitization does not require changes to your credit and collection policies or procedures, and the process is completely transparent to your customers. Customers continue to make payments into the same company accounts used prior to establishing a securitization, and customers are not notified or aware that the receivables have been securitized. Unlike a factoring program, receivables are pledged, rather than sold, to securitization lenders, and lenders do not take any equity, or upside, in the receivables. The proceeds from the securitization can be used to originate more assets, to reduce outstanding debt with higher interest costs or to provide for other capital needs.

Securitization allows your company to receive cash due from its trade receivables immediately, despite the fact that the payment terms may be 30 days or more. The interest cost is relatively low because the receivables’ cash flows are legally segregated and protected from other creditors in the event of a bankruptcy. This legal separation of the receivables has no impact on the company’s operations; the business continues to manage its accounts receivable (and customers) in the same manner as it did before the securitization. Securitization does not require changes to your credit and collection policies or procedures, and the process is completely transparent to your customers. Customers continue to make payments into the same company accounts used prior to establishing a securitization, and customers are not notified or aware that the receivables have been securitized. Unlike a factoring program, receivables are pledged, rather than sold, to securitization lenders, and lenders do not take any equity, or upside, in the receivables. The proceeds from the securitization can be used to originate more assets, to reduce outstanding debt with higher interest costs or to provide for other capital needs.

Key Benefits Of Securitizing Receivables

- Securitized debt has a lower interest

- Banks are generally willing to commit much larger amounts

- Securitization preserves capacity in the bank market.

- Securitization can increase your company’s total liquidity

- Securitization is non-recourse financing

- Securitization can enhance the enterprise value.

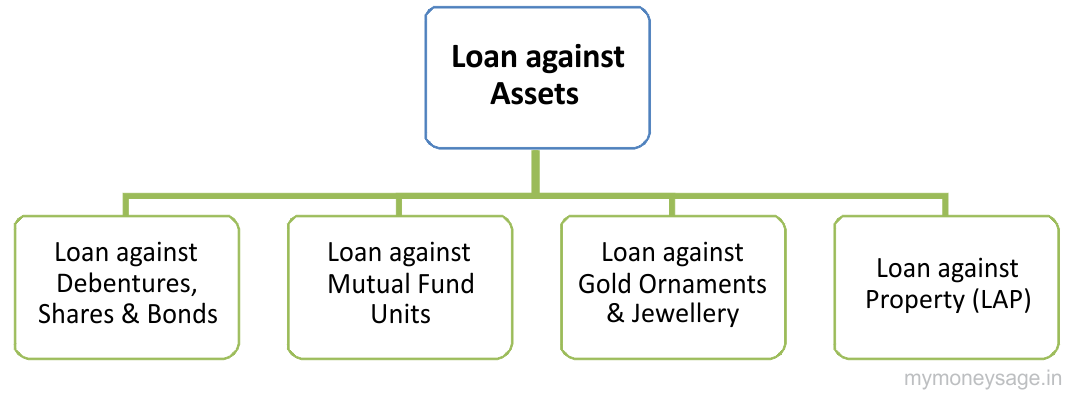

Loan Against Securities/Shares

Loan against Securities offers you instant liquidity. You don't have to sell your securities. All you have to do is pledge your securities in favor of Bank. Then bank will grant you an overdraft facility up to a value determined on the basis of the securities pledged by you. A current account will be opened and you can withdraw money as and when you require. Interest will be charged only on the amount withdrawn and for the time span utilized.

This facility is available against the following securities:

- Demat Shares

- Mutual Funds Units

- Fixed Maturity Plans (FMP)

- Exchange Traded Funds (ETF)

- Insurance Policies

- Savings Bonds

- NSC/KVP (Demat form)

Funding of Commercial Real Estate

The Scheme for lending to Commercial Real Estate Sector has been bifurcated into following broad categories:

- Bullet Loans extended to builders/developers for setting up residential complexes.

- Bullet Loans extended for setting up Shopping Malls

- Bullet Loans extended for Office Complexes

- Bullet Lease rental discounting.

Banks/ NBFCs provide Rupee Term Loans, Non fund based limits and overdraft facility to fund the Commercial Real Estate Sector.

Commercial Equipment Finance/Machinery Loan

For Each and Every Business, For Startup Or For Expansion Requires Machinery Loans.

Machinery Finance Contains Used machinery loan, loan for earthmover, Heavy equipment Loan, Printing Machinery Loan, Finance facility for JCB , ACE , Hitachi equipments like:-

- Generator/DG Sets

- CNC Machines

- Offset Printing Machines

- Industrial Power Presses

- Injection Moulding Machines

- Pressure/Gravity Die Casting Machines

- Other Industrial Machineries packaging/embossing/Bar Code Machines.

- Industrial Boilers

- Medical Equipments

- Infrastructure Equipments and

- Office Equipments

- Heavy Machinery

- VMC Machines

- Construction Machinery

- Printing Machinery

Commercial Vehicle Loans

The rate of interest for the commercial car loan depends on various factors like customer profiles and location. A commercial vehicle loan can be taken for a variety of commercial vehicles, which may be used at different locations. The commercial vehicle loan is applicable to customers with diverse profiles.

For new Commercial Vehicles

- Fast processing

- Greater flexibility

- Maximum tenure of 60 months

- Competitive rates

- Customised financing

For old Commercial Vehicles

- Finance against vehicles that are up to 15 years old

- Maximum tenure of up to 3 years

- Maximum finance flexibility

We call you back

Request a Call

Let's Talk Business

Talk to a Specialist

We suggest our clients the optimum funding solutions not only basis their current requirements but also keeping in mind the future growth of their businesses.

+91 - 22 62618700 info@invictuscapitaladvisors.comWhy choose us?

FAST LOAN APPROVAL

Our tie-up with banks & NBFCs across India help us get you a solution faster.

DEDICATED USERS

Achieving our mantra of satisfying our clients has been possible only because of our committed team.

SUPPORT

We are here not only to get you the loan you need, but also to assist you with answers for all your questions.